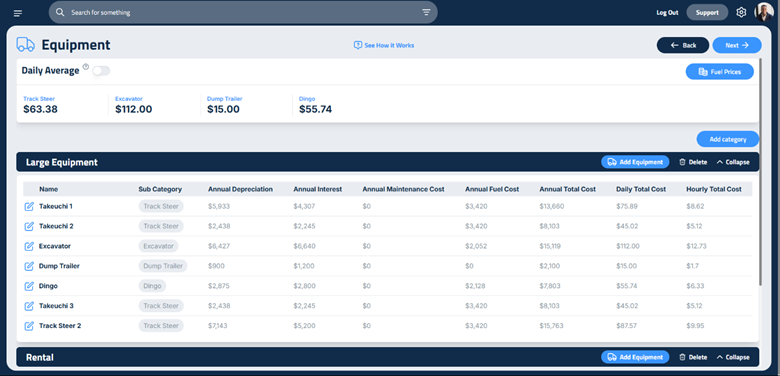

How to Set Up Equipment

Once you’ve completed the Profit Genie Wizard, the next step is to enter your equipment. This ensures that your estimates accurately reflect the cost of owning and operating the tools and machines your business depends on.

This section is more than just data entry, it’s about making sure your pricing reflects the real cost of doing business. Whether it’s a skid steer, a dump trailer, or a set of small tools, every piece of equipment you own has a cost, and Profit Genie helps you recover it.

Step 1: Set Fuel Prices

Start by clicking the Fuel Prices button in the top right corner of the screen. Enter the current prices for:

- Off-road diesel

- Diesel

- Unleaded

These values are used to calculate fuel costs for each piece of equipment. You’ll want to update them periodically as prices change.

Step 2: Create Equipment Categories

Next, create your equipment categories. A default category for Overhead Equipment is already included.

To add a new category, click Add Category and type in a name. Most users create a single additional category for Large Equipment, but you can add as many as needed to organize your equipment by type or function.

For example, if you want to separate small tools, click Add Category and create a custom category called “Small Tools.”

⚠️ Important: Equipment added to any category other than Overhead Equipment must be manually included in each proposal to be billed.

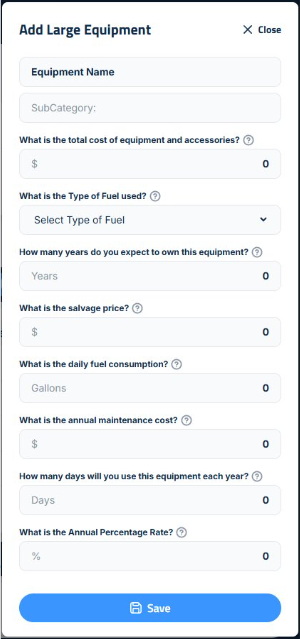

Step 3: Add Equipment

Once your categories are set, click Add Equipment to begin entering your machines. A sidebar will open where you can input all the details for each item.

Here’s what to enter:

- Unique Name: Be specific, use “Bobcat T770 Skid Steer” instead of just “Skid Steer.”

- Subcategory: Type a name (e.g., “Skid Steer”) and click Create Sub-Category, or select an existing one. Subcategories are used to calculate average hourly and daily rates for similar equipment.

- Total Cost or Replacement Value: Use today’s dollars, including any accessories. If you bought attachments (like a rock rake), list them separately under their own subcategory so they can be charged independently.

- Fuel Type: Select the fuel used by the equipment.

- Years of Ownership: Estimate how long you expect to own the equipment. Be conservative, this number determines how long the cost is spread across. Overestimating may result in under-recovery.

- Salvage Value: Enter the amount you expect to sell the equipment for at the end of its life. This value is subtracted from the total cost to determine what needs to be recovered.

- Daily Fuel Consumption: Enter the average gallons used per day. This should reflect typical use, not maximum capacity. You should be charging for the equipment every day it’s on-site, regardless of how much it’s used.

- Annual Maintenance Cost: Optional. If you don’t track maintenance per machine, enter zero and include all maintenance costs in your overhead section. If you do track maintenance individually, enter the amount here and do not include it again in overhead.

- Days Used Per Year: Estimate how many days per year the equipment will be used. This number is used to calculate your daily rate. Be conservative, if you overestimate and don’t meet that usage, you won’t recover your costs.

- Annual Percentage Rate (APR):

- If the equipment was financed, enter the loan’s interest rate plus 1% to account for inflation.

- If you paid cash, enter 7% or higher to reflect the opportunity cost of not investing that money elsewhere.

- If you prefer not to include interest, you may leave this field at zero.

Click Save to return to the main equipment page. Repeat this process for each piece of equipment you want to charge for on an hourly or daily basis.

Step 4: Add Overhead Equipment

This section includes items like company trucks, trailers, and small tools that are not billed per job. These are recovered through your hourly labor rate.

To add overhead equipment:

- Follow the same steps as above.

- Set Days Used Per Year to 365.

- Skip the fuel consumption field. Fuel for overhead equipment should be included in your overhead expenses.

Step 5: Add Rental Equipment

Rental equipment will be accounted for in your equipment catalog, but will not be shown in the Daily Average bar at the top of the screen

To add rental equipment:

- Follow the same steps as previous equipment types

- Only Equipment Name, Category, and Hourly, Daily, Weekly, and Monthly Charges will apply to rental equipment

Updated on: 12/11/2025

Thank you!